CJRS and furlough information

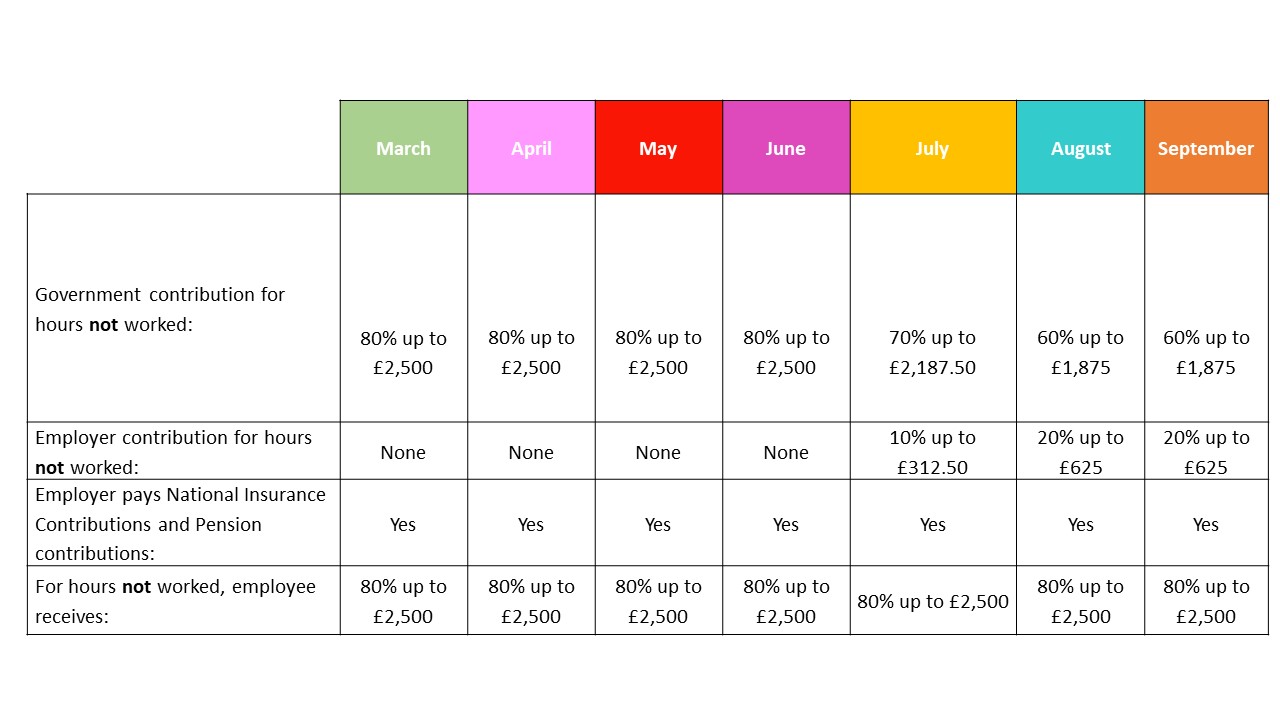

The Coronavirus Job Retention Scheme (CJRS) has now been extended until 30 September 2021. The level of grant available to employers under this scheme will remain the same until 30 June 2021.

From 1 July 2021, the level of grant will reduce, requiring participating firms to contribute towards their furloughed employees’ wages. To continue to be eligible for the scheme, employers must continue to pay their employees 80% of their wages, up to a cap of £2,500 per month for the time they spend on furlough (proportionate to the hours not worked in the case of flexible furlough).

For periods ending on or before 30 April 2021, you can claim for employees who were employed on 30 October 2020, as long as you have made a PAYE Real Time Information (RTI) submission to HMRC between 20 March 2020 and 30 October 2020, notifying a payment of earnings for that employee. You do not need to have previously claimed for an employee before the 30 October 2020 to claim for periods from 1 November 2020.

For periods starting on or after 1 May 2021, you can claim for employees who were employed on or before 2 March 2021, as long as you have made a PAYE Real Time Information (RTI) submission to HMRC between 20 March 2020 and 2 March 2021, notifying a payment of earnings for that employee.

Previous information on this can be found in the Archive here.